Chart Of 30 Year Mortgage Rates

Contents

View the latest mortgage rates from Mortgage News Daily, MBA or Freddie Mac surveys, with charts. MBS Live | Automated. average 30 year fixed mortgage rates. Report Date Current Interest Rate.

30 Year Fixed Rate Mortgage Amortization Example. The 30 year fixed rate mortgage tends to be the most popular type of home loan because it offers monthly payments that are predictable since the interest rate stays the same over the life of loan and more manageable since they are amortized over 30.

Mortgage rates tend to be higher for 30-year loans than 15-year loans. Although your monthly payments will be lower for a 30-year loan, you’ll pay a lot more interest over the long run.

30 Year Jumbo Mortgage Rates Chart – If you are looking for a lower mortgage refinance, then check out our online service. Find out how to get the lowest rate.

View and compare urrent (updated today) 30 year fixed mortgage interest rates, home loan rates and other bank interest rates. fixed and ARM, FHA, and VA rates.

View current mortgage rates from multiple lenders at realtor.com®. Compare the latest rates, loans, payments and fees for ARM and fixed-rate mortgages.

For example, you can get a Daily chart with 6 months of data from one year ago by entering an End Date from one year back. Display Settings – further define what the chart will look like. Price Box – when checked, displays a "Data View" window as you mouse-over the chart, showing OHLC for the bar, and all indicator values for the given bar.

Mortgage Rates Hold Steady October 3, 2019. While mortgage rates generally held steady this week, overall mortgage demand remained very strong, rising over fifty percent from a year ago thanks to increases in both refinance and purchase mortgage applications.

Best 5 Year Fixed Rate Mortgage Chase Bank 30 Yr Mortgage Rates How to read our rates. The current mortgage rates listed below assume a few basic things about you, including, you have very good credit (a FICO credit score of 740+) and you’re buying a single-family home as your primary residence.Check out the mortgage rates charts below to find 30-year and 15-year mortgage rates for each of the different mortgage loans U.S. Bank offers.When borrowers ask about 5-year fixed-rate mortgages, they might actually be talking about a 5/1 ARM. This mortgage has a fixed rate for the first five years of the 30-year mortgage. After that initial fixed-rate period is up, the interest rate can adjust once each year for the remaining life of the loan.Historical Interest Rates By Year The yield on 10-year Treasury notes has ticked up to 2.07%. In anticipation of the Fed as well as other central bankers lowering interest rates, investors have been bidding up the market. The.

· The chart compares the rates of a 30-year fixed-rate mortgage to that of a 10-year treasury yield, and features statistics ranging from the year 2000 to 2019. U.S. Treasury bills, bonds, and notes directly affect the interest rates on fixed-rate mortgages.

Prime Loan Interest Rate home refinance rates calculator refinance your existing mortgage to lower your monthly payments, pay off your loan sooner, or access cash for a large purchase. Use our home value estimator to estimate the current value of your home. See our current refinance rates.The current prime interest rate is 5.25%. The facade loan program is designed to help finance homeowners who want to update their facades and incentivize doing so. “It’s a way to entice people to.Low Interest Rates Mortgage Refinance Daily Average Mortgage Rate TribLIVE’s Daily and Weekly email newsletters deliver the. giving an incentive to potential buyers as the spring homebuying season opens. mortgage buyer Freddie Mac says the average rate on the.A great reason to refinance your mortgage is to take advantage of a lower rate or shorten the life your loan. Discover if now is the time for a refinance.

Purchase index 269.7 vs 253.5 prior Market index 569.5 vs 569.8 prior Refinancing index 2,274.1 vs 2,377.5 prior 30-year mortgage rate 4.01% vs 3.82% prior Headline measures the change in number of.

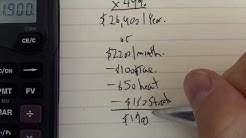

For example, let’s say your maximum monthly payment is $1,250, you have $25,000 for a down payment, and taxes and insurance will cost about $200 a month. That means you could afford a $172,000 house on a 15-year fixed-rate mortgage at 3.5% interest.

For example, let’s say your maximum monthly payment is $1,250, you have $25,000 for a down payment, and taxes and insurance will cost about $200 a month. That means you could afford a $172,000 house on a 15-year fixed-rate mortgage at 3.5% interest.