How Much Loan Can I Afford Calculator

Contents

See how much you can afford to spend on your next home with our Affordability Calculator. Calculate your affordability to see what homes fit into your budget.

Calculator Use. How much of a loan can you afford to take out? This calculator will help you answer that question. Shopping for a car or boat or looking to take out a home equity loan? This calculator should give you a rough idea of how much loan you can afford to take based on the monthly payment you can make and the current interest rate.

Fha Loans For First Time Home Buyers FHA home loans are flexible and accessible. home buyers today don’t often buy homes with 20% down. Low- and no-downpayment mortgages remain popular with first-time buyers and repeat buyers alike.How To Get First Mortgage How to Get Copies of a Mortgage Deed Promissory Note Although home loans are commonly referred to as "mortgages," the loan itself is not the mortgage. The mortgage is the instrument that secures.

How much should I be saving for retirement? There’s no easy answer here because retirement is not one-size fits all. You can start by using an online calculator to find out. you’d still be able to.

In nearby towns like West Chester, homes are much more likely to go for higher. and we try to pay ahead on the mortgage whenever we can. Personal Finance Insider offers tools and calculators to.

Mortgage Type: The type of mortgage you choose can have a dramatic impact on the amount of house you can afford, especially if you have limited savings. FHA loans generally require lower down payments (as low as 3.5% of the home value), while other loan types can require up to 20% of the home value as a minimum down payment.

Texas First Time Homebuyers Program DALLAS–(BUSINESS WIRE)–The Federal home loan bank of Dallas (FHLB Dallas) is pleased to announce that, in partnership with its member financial institutions, it has awarded $14 million in Affordable.

How Much Can I Afford? fha mortgage calculator. Use the following calculator to help you determine an affordable monthly payment so that you know what you can afford before you make an offer on the home you want to purchase.

![]() Affordability Calculator. Estimate the home price you can afford by inputting your monthly income, expenses and specified mortgage rate. Adjust the loan terms from 15-, 20- and 30-year mortgages and see your estimated home price, loan amount, down payment and monthly payments change.

Affordability Calculator. Estimate the home price you can afford by inputting your monthly income, expenses and specified mortgage rate. Adjust the loan terms from 15-, 20- and 30-year mortgages and see your estimated home price, loan amount, down payment and monthly payments change.

Use our home affordability calculator to figure out how much house you can afford. Use our home affordability calculator to figure out how much house you can afford.. student loan and car.

How Much House Mortgage Can I Afford VA Mortgage Calculator How Much Can I Afford? Use the following calculator to help you determine an affordable monthly payment so that you know what you can afford before you make an offer on the home you want to purchase.

You can also refinance student loans to get a lower interest rate or even. No matter where you choose to live, make sure you’re searching for homes you can afford. Use a calculator to determine how.

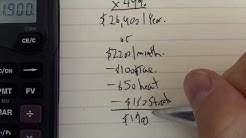

For example, let’s say your maximum monthly payment is $1,250, you have $25,000 for a down payment, and taxes and insurance will cost about $200 a month. That means you could afford a $172,000 house on a 15-year fixed-rate mortgage at 3.5% interest.

For example, let’s say your maximum monthly payment is $1,250, you have $25,000 for a down payment, and taxes and insurance will cost about $200 a month. That means you could afford a $172,000 house on a 15-year fixed-rate mortgage at 3.5% interest. By this measure, a single adult with a $50,000 annual salary, or $4,167 in gross pay per month, can pay housing costs of up to $1,167 per month. This includes payments toward your mortgage. and buy.

By this measure, a single adult with a $50,000 annual salary, or $4,167 in gross pay per month, can pay housing costs of up to $1,167 per month. This includes payments toward your mortgage. and buy.