How Much House Can I Afford By Payment

Contents

The home affordability calculator from realtor.com helps you estimate how much house you can afford. Quickly find the maximum home price within your price range.

How Much House Could I Afford Based On How Much I Currently Pay In Rent? This calculator allows you to figure out mortgage affordability based on current income and rental payments.

Can We Afford A House El Paso First Time Home Buyers Income To Afford House How Much House Can I afford? house affordability calculator. There are two house affordability calculators that can be used to estimate an affordable purchase amount for a house based on either household income-to-debt estimates or fixed monthly budgets. They are mainly intended for use by the U.S. residents.There is also additional assistance for first time home buyers. The program is available everywhere in Texas except for El Paso, Grand Prairie.How much can you really afford to spend on a house? Before you even start house hunting, make sure you decide — with no outside pressure — the maximum amount you will spend on a house. Photo.

How much house can you afford? Find out in 6 steps. October 1, 2018. So, you want to buy a home. but you’re not sure how much house you can afford. Maybe you’re not sure if you can afford to buy one at all. Well, we’ve got finding a realistic price tag down to just 6 steps, and you don’t even have to do any math.

How Much Afford House Redfin’s Home Affordability Calculator will help you figure out how much house you can afford by using your income, down payment, monthly debt and current mortgage rates to search current real estate listings in your expected price range.

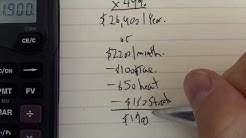

For example, let’s say your maximum monthly payment is $1,250, you have $25,000 for a down payment, and taxes and insurance will cost about $200 a month. That means you could afford a $172,000 house on a 15-year fixed-rate mortgage at 3.5% interest.

For example, let’s say your maximum monthly payment is $1,250, you have $25,000 for a down payment, and taxes and insurance will cost about $200 a month. That means you could afford a $172,000 house on a 15-year fixed-rate mortgage at 3.5% interest.

How much house can I afford? Including your mortgage, your monthly debt payments should not exceed 45 percent of your total income. With that in mind, important factors to consider when setting.

If your down payment is at least 20 percent on a conventional mortgage. These programs might help you reduce your costs and get into the home you want. The question of how much house you can afford.

Calculating how much you can afford to borrow for a home can be sobering, but it’s also liberating. Once you fully understand your potential borrowing power, you can refine your house search to what you know you’ll be able to buy, and your vision of a dream home can become a reality.

Home Loan Estimator Based On Income The calculator will try to calculate what kind of income lenders will expect you to be making to qualify for the specific values. property tax and home insurance numbers will , of course, vary from loan to loan, so these results should be used only as a benchmark as to what an individual lender would qualify you for.Mortgage Companies For First Time Home Buyers Homeownership can feel out of reach, especially if you’ve never purchased a home and aren’t sure whether you’ll qualify for a mortgage. for buying a home in the Sunshine State below. These national.

On the one hand, you’ll definitely want to make sure that you purchase a home that suits your needs, but on the other, you don’t want to be left feeling "house. much home you can afford to buy.

Make sure you budget for homeowners insurance when calculating how much house you can afford. Homeowners insurance is typically around $1000 per year. It can be more or less, depending on your home value. Our mortgage affordability calculator factors in the homeowner insurance premium into your monthly payment.

Current 15-Year Mortgage Rates on a $220,000 Home Loan. By default 15-year purchase loans are displayed. Clicking on the refinance button switches loans to refinance. Other

Current 15-Year Mortgage Rates on a $220,000 Home Loan. By default 15-year purchase loans are displayed. Clicking on the refinance button switches loans to refinance. Other  Ben Carson, Secretary of the Department of Housing and Urban Development, revealed that the department will address FHA.

Ben Carson, Secretary of the Department of Housing and Urban Development, revealed that the department will address FHA.