What Is Plano Texas Known For?

Contents

The Interurban Railway Museum, also known as Plano Station, texas electric railway, is a historic train station. The city's first train station, built in 1908, was.

Find Plano’s best sports-friendly hotels, restaurants and attractions at Plano’s sport survival guide. “visit plano and the athletics staff of Plano Parks and Recreation is thrilled to host the GOLD.. Blist’r fresh naan wraps – Best indian food restaurants near me in Plano, Frisco Texas(TX). We offer delicious tandoor naan, fresh naan wraps, wrap roti grill in.

Plano, Texas – Wikipedia – Plano (/ p l e n o / PLAY-noh) is a city in the U.S. state of Texas, located approximately twenty miles (32.2 km) north of downtown Dallas.The city of Plano is a part of the dallas-fort worth metropolitan area.plano lies mostly within Collin County, but includes a small portion that extends into Denton County.

Best Nightclubs In Plano Plano’s newest addition, Shark Club. There’s a window that shows off all of the bars and cookies her team has freshly prepared, but Bautista wants to make sure they focus on the ice cream. After.Home Mortgage Plano home loans to thousands of homebuyers, and today we are among the largest mortgage lenders in the nation. What sets Colonial apart from most mortgage companies is retained servicing. What sets Colonial apart from most mortgage companies is retained servicing.

Based in Plano, Texas, they have 14,000 employees and a market. but the true extent to which they populate the market. Plano is known as one of the safest cities in the United States, and it also has some of the most competitive schools systems you’ll ever find. I’ve grown up in Plano since I was 5, living in the central part of the town.

What is Plano Texas known for? Plano, Texas | Uncyclopedia | FANDOM powered by Wikia – Plano, Texas is a neighborhood in Dallas where even the black people are rich snobs who drive Hummers.It is located just north of Dallas, Texas, and south of Two Cows, Oklahoma.It has a population of 4,360,000, many of which Ted Turner is planning to kill for his own amusement.. plano boasts state-of-the-art.

Flower Delivery to Plano, TX – fromyouflowers.com – This is one of the best places to live in Texas due to its high public safety and thriving economy. Plano is known for its vibrant arts scene and historic downtown district, as well as a unique entertainment district. In the 90s it was known for heroine.

What Is Plano Texas Known For? international public Safety Consortium 2020( Known as. – Plano enjoys a reputation as one of the most desirable cities to live and work in. Plano was recently named as one of the “Safest Cities in America” and “Best Run Cities in America” by Law Street Media and 24/7 Wall Street respectively.

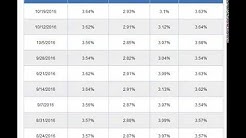

Rates and program information are deemed reliable but not guaranteed. Rates on this page are based on the purchase of a single-family, single-unit, detached, primary residence located in Richmond, VA (home of SunTrust Mortgage, A Division of SunTrust Bank). Rates also assume a 30 day lock and are subject to change without prior written notice.

Rates and program information are deemed reliable but not guaranteed. Rates on this page are based on the purchase of a single-family, single-unit, detached, primary residence located in Richmond, VA (home of SunTrust Mortgage, A Division of SunTrust Bank). Rates also assume a 30 day lock and are subject to change without prior written notice.