what are the rates for a 30 year fixed mortgage

Contents

Mortgage rates held steady this past week after hitting a new low for 2019 just a few weeks ago. Average 30-year mortgage rates today increased to 3.65 percent last week, up from the prior week’s average rate of 3.64 percent. Back in early September, average 30-year mortgage rates fell to a fresh low of 3.49 percent.

The most popular mortgage product is the 30-year fixed rate mortgage (FRM). This article discusses how the 30-year compares to other mortgage products,

Since the length of the loan term is longer, 30-year fixed mortgage rates tend to be higher than 15-year fixed mortgage rates. For example, take a family of four. Let’s say they decide to buy a $250,000 house with 20% down ($50,000) and lock in a 30-year fixed rate mortgage at 3.75%.

Mortgage rates and terms vary from lender to lender, so if you want to find the best 30-year fixed-mortgage rates, for example, you’re going to have to do some digging. Check the ads, go online and ask for quotes from various lenders.

The 30-year fixed mortgage rate has dropped to 3.60% from a peak of 4.94% in November, according to data from mortgage.

The 30-year fixed mortgage rate has dropped to 3.60% from a peak of 4.94% in November, according to data from mortgage.

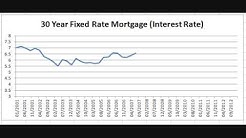

30 Year Fixed Mortgage Rate – historical chart. interactive historical chart showing the 30 year fixed rate mortgage average in the United States since 1971. The current 30 year mortgage fixed rate as of September 2019 is 3.64.

The average 30-year fixed mortgage rate fell 8 basis points to 3.83% from 3.91% a week ago. 15-year fixed mortgage rates fell 8 basis points to 3.20% from 3.28% a week ago.

Bankrate's rate table compares today's home mortgage & refinance rates.. Rate. 3.250 %. 30 year fixed refinance; Points: 0.924; Fees: $4,374. NMLS #164626.

A conforming 30-year fixed rate loan offers amounts up to $484,350 in most of the US and a maximum of $726,525 in high-cost areas. To decide if a 30-year fixed mortgage is right for you, ask yourself these four questions: How long are you planning to stay in your home?

current fha mortgage rates in Texas ContentsCurrent fha interest ratemortgages. mortgage insurance premiumsYear fixed rate30 year mortgageCompare current mortgage rates in Texas and save money by finding best mortgage rates in Texas. Get customized mortgage rates from Hsh.com10 biggest mortgage mistakesLaredo home loans Laredo, TX USDA home loans or sometimes called rural development loans, are government-insured mortgages that help potential home buyers buy a home without a down payment. The Laredo, TX USDA home loan program was created in 1991. This program was designed to help aid potential home buyers obtain a mortgage with a decent rate in rural areas.

30-year and 15-year fixed-rate mortgages. monthly mortgage payments includes a portion that is applied toward both principal and interest. 4 principal goes directly to pay off the loan, increasing the equity you have in your home. Interest is the cost of borrowing the money.