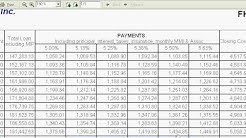

Fha Loan Amortization

Contents

30 Yr Fha Rate Virginia 30-Year Fixed Jumbo Mortgage. Rates from this table are based on loan amount of $600,000 and a variety of factors including credit score and loan to value ratios. For specific requirements please check with the lender. Rates may change at any time.

Paying Off a Loan Over Time. When a borrower takes out a mortgage, car loan, or personal loan, they usually make monthly payments to the lender; these are some of the most common uses of amortization. A part of the payment covers the interest due on the loan, and the remainder of the payment goes toward reducing the principal amount owed.

Annual Amortization Schedule. The FHA was established in 1934 after The Great Depression and its continuing mission is to create more homeowners in the US. Therefore, it is plain obvious that the popularity of FHA loans comes from their ability to extend mortgage loans to almost anyone trying to buy a home.

Annual Amortization Schedule. The FHA was established in 1934 after The Great Depression and its continuing mission is to create more homeowners in the US. Therefore, it is plain obvious that the popularity of FHA loans comes from their ability to extend mortgage loans to almost anyone trying to buy a home.

If your loan is set on a 30-year time period, as are most mortgages, one way to use amortization to your advantage is to refinance your loan. Refinancing is how you change the schedule on which you’re required to pay off the loan, say from 30 years to 20 or even 15.

Mortgage Amortization Schedule Extra Payments – We are providing refinancing options that fits your needs. If you consider to refinance your mortgage loan don’t waste your time and submit the form.

Amortization Chart Mortgage Calculator – Visit our site and see if you can lower your monthly mortgage payments, you can save money by refinancing you mortgage loan. Your payment will be higher, but the interest you pay much less over the life of the loan, thus saving your hard earned money.

Pmi Vs Higher Interest Rate The higher rate – does not. So, no-PMI option is much better. To the bank, as you suspected. Your calculations are correct. With the PMI you’ll pay less interest, and more balance. As to the tax deductions, interest can be deducted, but the PMI – no (starting of 2012, to the best of my understanding, at least).

Sun West updated its Sunsoft system to allow loan submissions and locks on FHA Streamline Refinance loans with odd amortization terms from 16 to 29 years allowing Customers to lower their monthly.

Jumbo Loan 10 Down No Pmi fha intrest rates An fha (federal housing administration) loan is a government-backed home mortgage loan with more flexible lending requirements than conventional loans. Because of this, FHA mortgage interest rates may be somewhat higher.VA loan pros With or without a credit score requirement, VA loans have several significant advantages, including: A zero down payment requirement. No monthly private mortgage insurance. you can.

An FHA loan is a mortgage loan that’s backed by the Federal Housing Administration. Borrowers are required to pay a , which reduces the lender’s risk if a borrower defaults.

FHA loans are from private lenders that are regulated and insured. appraisal performed by a lender approved appraiser to replace the scheduled amount in your amortization schedule. You may not need.

refinance from fha to conventional Mortgage Rate Compare NerdWallet’s comparison tool can help you find the best refinance rates for your mortgage. Enter a few details about your current home loan and we‘ll scan hundreds of lenders to find the best.No Pmi 5 Down · How much does pmi cost? pmi is typically an annual premium of .05 percent to 1 percent of the original loan amount per year, depending on the size of the down payment and your credit score.Conventional Versus FHA Refinancing By Gretchen Wegrich Updated on 7/24/2017. refinance loan options can be split into two categories: conventional mortgage loans and government-insured, most commonly those insured by the Federal Housing Administration (FHA).

The formula for calculating monthly mortgage insurance premium became effective May 1, 1998 (see Mortgagee Letter 98-22 Attachment).. Below is the monthly mortgage insurance premium (MIP) calculation with examples and pseudocode using the annual and upfront MIP rates in effect for mortgages assigned an FHA case number before October 4, 2010.