Fha Rate Increase

Fha Home Equity Loan With Bad Credit Getting a home equity loan with bad credit requires a debt-to-income ratio in the lower 40s or less, a credit score of 620 or higher and home value of 10-20% more than you owe. Getting a loan when your credit score has taken a downward slide can be tough. Your home may hold the answer – with the value that it has accrued over time.

*Adjustable Rate Mortgage (ARM) interest rates and payments are subject to increase after the initial fixed-rate period (5 years for a 5/1 ARM, 7 years for a 7/1 ARM) and assume a 30-year repayment term. FHA, VA and other mortgage loan terms and programs are available.

· Mortgage Rates Continue To Decrease. Any potential home buyers will want to track changes in the market over the coming months. Over the past week, mortgage rates decreased to 4.51%, a slight drop of two basis points (0.02%) from the previous week. This is the lowest that mortgage rates have been since mid-April.

FHA mortgage rates hew closely to the mortgage rates on traditional home loans. If the average interest rate on a 30-year fixed-rate mortgage stands at 5.4 percent, you can figure that the average fha mortgage rate is nearly the same. This makes these loans even more attractive.

Fha Loan Process Step-By-Step The mortgage qualification process is very complex for most home buyers. This holds true especially to first time home buyers; We have decided to write and publish this Step By Step Of Home Loan Process For home buyers blog especially first time home buyers. The FHA mortgage process can be both intimidating and confusing to a first-time borrower.

Fha Apr Rates – We are providing refinancing options that fits your needs. If you consider to refinance your mortgage loan don’t waste your time and submit the form. How to get a 80/20 MortgageA good accommodation for direct buying clothes for a / 80 20 mortgage is a mortgage broker.

The delinquency rate for fha loans increased 55 basis points – the biggest increase of the government loans – and reached 9.02% in the fourth quarter. That’s up from 8.30% in the third quarter. Most.

FHA refinance rates. Current FHA rates are some of the lowest in history. According to Ellie Mae’s January 2019 Origination Report, the average 30-year rate on FHA loans decreased to 5.05 percent. This keeps FHA rates on par with conventional loan rates at 5.04 percent.

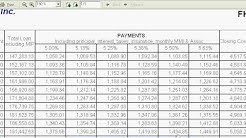

Under Public Law 111-229(1)(b), FHA may adjust its mortgage insurance premium rates, as measured in basis points (bps), by Mortgagee Letter. The first table shows the previous and the new annual MIP rates by amortization term, base loan amount and LTV ratio. All MIPs in this table are effective for case numbers assigned on or after April 1, 2013.

Many consumers couldn’t qualify, that was before the Federal Housing Administration was created to help increase homeownership in America. The FHA does not issue the loans, they insure them in case a borrower defaults on the mortgage loan. This makes FHA lending less risky for lenders, allowing them to lower their minimum requirements.

Annual Amortization Schedule. The FHA was established in 1934 after The Great Depression and its continuing mission is to create more homeowners in the US. Therefore, it is plain obvious that the popularity of FHA loans comes from their ability to extend mortgage loans to almost anyone trying to buy a home.

Annual Amortization Schedule. The FHA was established in 1934 after The Great Depression and its continuing mission is to create more homeowners in the US. Therefore, it is plain obvious that the popularity of FHA loans comes from their ability to extend mortgage loans to almost anyone trying to buy a home.