Get A Morgage Quote

Contents

Bolden on his touchdown pass: “It was a great experience, not gonna lie. You pray for times like this, that you finally get a.

Use our mortgage calculator to estimate your monthly mortgage payment.. We take our calculator a step further by factoring in your credit score range, zip code .

Best Site For Mortgage Rates A 5/1 adjustable mortgage rate starts off low for the first five years. Then the rate increases every year thereafter. If you’re really not sure how long you will be in the home, it’s probably best to just lock in a fixed rate since current mortgage rates are at all time low’s now. Read more about 5-1 ARM vs 30 year fixed rate mortgages.

Get a fast, no obligation mortgage rate quote in greater Chicago from a local lender you can trust. Start here to save money and avoid hidden fees. Check reviews and see why United Home Loans is the best in the business.

First Time Home Buyer Qualifications First-time home buyer qualification checklist. buying your first home is both exciting and stressful. Making sure you have all the documents prepared before you apply for a loan should reduce anxiety and streamline the process. The more information you have about credit, debt and income to share with the lender, the better his assessment will be about your loan options.

NerdWallet’s mortgage rate tool can help you find competitive. You’ll be on your way to getting a personalized rate quote, without providing personal information. From there, you can start the.

Earlier this week, I published these articles: I wrote about the definitive answer to paying down your mortgage, first, or.

Several groups have joined forces to help, including the long island housing Partnership, The State of New York Mortgage.

Fha Rate 30 Year Fixed First Time Home Buyer Qualifications First-Time Homebuyers If you’re’ considering buying your first home, there are a number of FHA Loan and other programs that can assist you with your purchase. Individuals and spouses without ownership of a principal residence during the past three years.Rates as of: June 30, 2019, 1:00 AM EST. Insured by the federal housing administration (FHA) and ideal for first-time. 10- to 30-year fixed, 30-year (ARM) .What Requirements Are Needed To Buy A House The lower down payment requirements with an FHA mortgage make it a good. This includes whether you are buying a single-family-home or a two- to four-unit property.. mortgage, although mortgage insurance will be required.. on the size of the house and the number of people in the veteran's family.

Accurate Quotes, Not Estimates. Online Process. Only Takes A Few Minutes. Mortgage experts available to explain loan options.. Get a Mortgage Rate Quote.

Get a mortgage rate quote. bills.com makes it easy to get a mortgage rate quote.

Fha 30 Yr Fixed Rates Today Mortgage buyer Freddie Mac said Thursday the average rate on the benchmark 30-year, fixed-rate mortgage was unchanged from last week at 4.45 percent. Rates remain above last year’s levels, however..

we all want to get the best mortgage rates. But when it comes to getting the best rate, there is something even more important than saving up for that down payment or getting quotes from multiple.

Calculate your monthly mortgage payments with taxes and insurance for a VA home loan. Talk with your Loan Officer to get a more accurate estimate for your .

Get a Mortgage quote. There are a number of different mortgages available. Make sure you get the right one tailored to your needs. What type of mortgage is required? Remortgaging Moving Home First time buyer Buy to let Other.

Get A Mortgage Quote Online – If you are looking for mortgage refinance service to reduce existing loan rate or to buy new home then our review of the best refinance sites is the right place for you.

Margaret Atwood on Extinction Rebellion — "This is our last chance as the human race. If we don’t get it right soon, that’s.

Even first-time buyer programs and other low or no down payment loans can come with a caveat. More often than not, this PMI or private mortgage insurance. This is an additional expense that borrowers must continue to pay until they’ve paid for at least 20 percent of their homes.

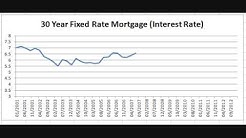

Even first-time buyer programs and other low or no down payment loans can come with a caveat. More often than not, this PMI or private mortgage insurance. This is an additional expense that borrowers must continue to pay until they’ve paid for at least 20 percent of their homes. The 30-year fixed mortgage rate has dropped to 3.60% from a peak of 4.94% in November, according to data from mortgage.

The 30-year fixed mortgage rate has dropped to 3.60% from a peak of 4.94% in November, according to data from mortgage.